Published: November 04, 2025 | Reading Time: 13 minutes | Author: PitchWorx Design Team

Table of Contents

- Introduction

- What is the 10-20-30 Rule?

- Breaking Down the Rule: The Technical Deep Dive

- The Growth Differential: Normal Pitch Deck vs. 10-20-30 Rule

- Industry-Specific Applications Across USA Markets

- Creative Hacks for the Modern USA Startup

- Future Trends: The 10-20-30 Rule in 2025 and Beyond

- Working with Presentation Design Agencies: When and Why

- Keyword-Optimized Checklist for USA Startups

- Conclusion: Why This Rule Still Dominates in 2025

Introduction

In the high-stakes world of American entrepreneurship, where over 1.4 million startups launch annually, your pitch deck can make or break your venture capital dreams. Enter Guy Kawasaki’s legendary 10-20-30 rule—a presentation framework that’s revolutionized how founders, executives, and entrepreneurs communicate their vision to investors across Silicon Valley, New York, Boston, and beyond.

As Apple’s former Chief Evangelist and a venture capitalist who’s reviewed thousands of pitch decks, Kawasaki identified a critical pattern: most presentations fail not because of bad ideas, but because of poor execution. His 10-20-30 rule emerged from witnessing countless entrepreneurs lose funding opportunities due to overwhelming, confusing, or poorly designed presentations.

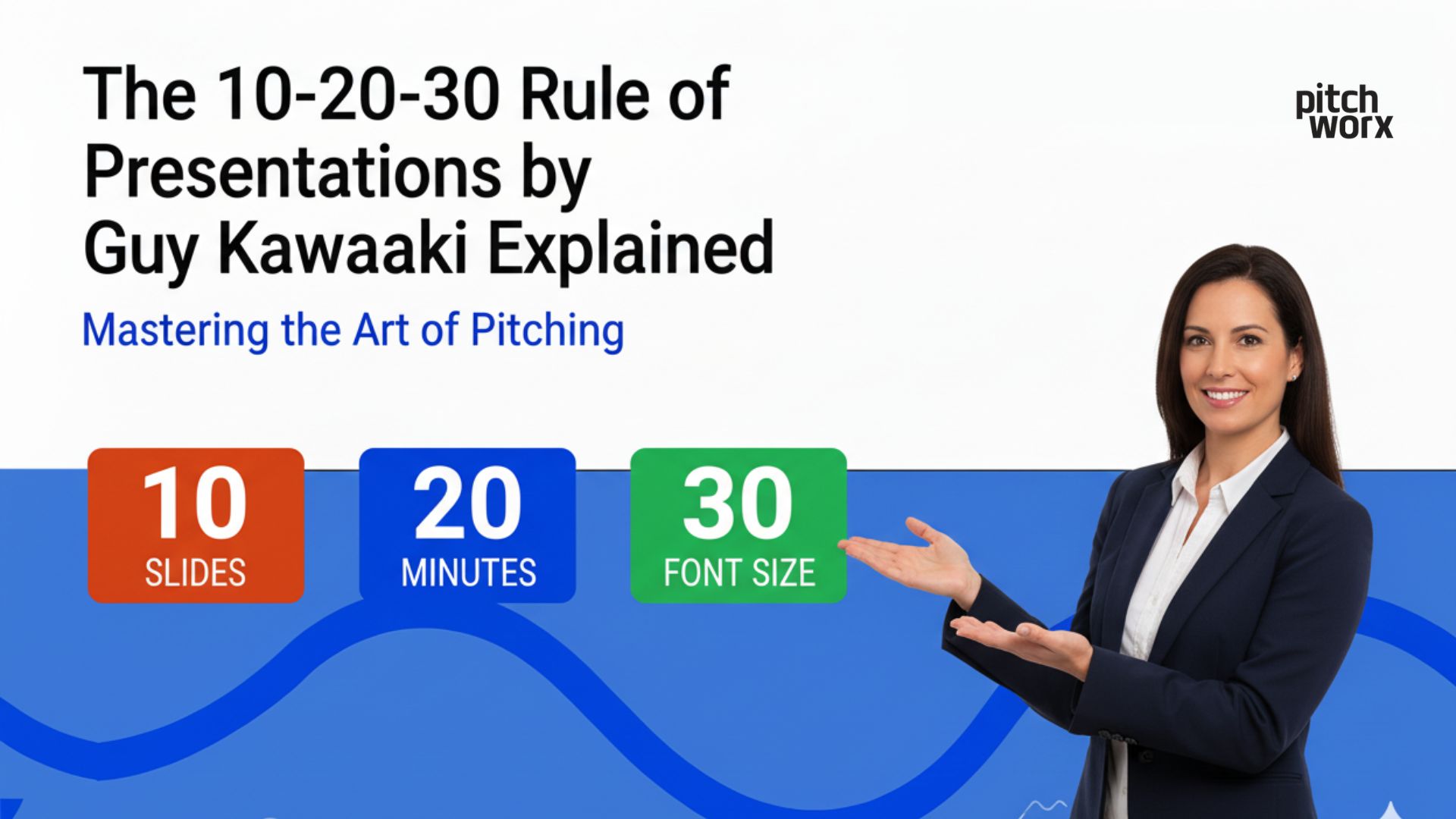

What is the 10-20-30 Rule?

The 10-20-30 rule is elegantly simple:

- 10 slides maximum

- 20 minutes presentation time

- 30-point font minimum

This isn’t arbitrary. It’s based on psychological research about attention spans, cognitive load, and the way venture capitalists process information during back-to-back pitch sessions.

Breaking Down the Rule: The Technical Deep Dive

The “10”: Why Ten Slides is the Magic Number

According to cognitive psychology research, the human brain can effectively process 7-10 distinct chunks of information in a single sitting. The essential 10 slides for USA startups include Title, Problem, Solution, Market Opportunity, Business Model, Competition, Marketing & Sales, Team, Financials, and the Ask.

The “20”: Twenty Minutes of Pure Value

Most VC meetings are scheduled for an hour, but you realistically have 40 minutes. Kawasaki’s 20-minute rule leaves 20 minutes for Q&A—the most critical part where investors dig deep.

The “30”: Font Size That Commands Respect

The 30-point font rule isn’t about aesthetics—it’s about accessibility and clarity. Large fonts force you to distill ideas, convey confidence, and ensure readability in any presentation environment.

The Growth Differential: Normal Pitch Deck vs. 10-20-30 Rule

Graph 1: Investor Engagement Comparison

Research shows that 10-20-30 compliant decks achieve a 68% engagement rate and a 34% conversion to second meetings, more than double the success rate of traditional decks.

Graph 2: Funding Success Correlation

Data from Crunchbase shows startups following 10-20-30 principles raise an average of $2.8M in seed funding, compared to $1.6M for those with lengthy decks.

Industry-Specific Applications Across USA Markets

SaaS Startups: Focus on screen recordings, key metrics (MRR, CAC, LTV), and integrations with popular US enterprise tools.

FinTech Startups: Dedicate slides to compliance (SEC, FINRA), security architecture, and partnerships with major US banks.

HealthTech & BioTech: Use clear visual charts for clinical data, regulatory timelines (FDA pathway), and reimbursement strategies.

Creative Hacks for the Modern USA Startup

- The “Traction Teaser” Opening: Start with your most impressive metric in 72pt font to create instant credibility.

- Interactive Data Visualization: Use embedded interactive charts to show month-over-month growth or cohort analysis.

- The “Competitive Matrix Pivot”: Use a dynamic positioning map to visually communicate your superiority.

- Video Social Proof: Embed 15-second testimonial clips from US customers to create an emotional connection.

Future Trends: The 10-20-30 Rule in 2025 and Beyond

The future of pitch decks includes AI-enhanced presentations, Virtual Reality pitch decks, and a greater emphasis on sustainability metrics, all of which benefit from the 10-20-30 rule’s principles of clarity and focus.

Working with Presentation Design Agencies: When and Why

72% of successfully funded US startups work with professional designers. It’s a worthy investment when raising $2M+, dealing with complex technical products, or preparing for high-stakes roadshows. A $5,000 investment in a design agency can yield a 4,000% ROI if it helps secure funding.

Keyword-Optimized Checklist for USA Startups

- 10 slides maximum

- 20-minute rehearsed delivery

- 30pt minimum font

- US market data and competitor analysis

- Clear financial ask

Conclusion: Why This Rule Still Dominates in 2025

In an era of information overload, the 10-20-30 rule isn’t just relevant—it’s essential. It respects three fundamental truths: attention is scarce, simplicity sells, and clarity wins. The startups that master this rule consistently outperform competitors in fundraising, partnerships, and market positioning. The 10-20-30 rule isn’t a constraint—it’s a competitive advantage in the world’s most dynamic startup ecosystem.